In the previous article, titled "The Hidden Agenda of the New World Order", we discussed the imminent implementation of the digital euro, scheduled for October 2025.

The European Central Bank (ECB) has been conducting a series of experiments to assess the potential of digital payments, carrying out various trials with the digital currency in recent months. This project continues to move forward, and recently, Christine Lagarde, President of the ECB, defended its viability at an event in Strasbourg, emphasizing that the digital euro is: "a necessary tool of European sovereignty...The deadline will be October, and we are preparing for it," she asserted, before insisting that it will function as an electronic version of cash and will be primarily a retail payment method, as it "will offer another way to pay in stores or online, or to send money to friends and family."

Christine Lagarde, President of the European Central Bank (ECB) since November 2019, announced the acceleration of the development of the digital euro during her speech following the ECB's monetary policy meeting on March 6. Responding to questions from the media, he stated that the institution is "stepping on the gas" to bring this new digital currency to fruition as soon as possible.

One of the most controversial issues surrounding the digital euro is the anonymity of transactions. Lagarde had already stated in 2022 that "total anonymity, similar to that offered by cash, is not a viable option."

It is important to note that Lagarde, who also served as managing director of the International Monetary Fund (IMF), was not elected by any citizen through a democratic process, but was directly appointed to her position.

The ECB is accelerating the imposition of the digital euro to increase control over Europeans1

It should be noted that what we are currently experiencing is not a coincidence, but rather part of an elaborate and sinister plan aimed at eradicating physical money. This movement, which many might consider a simple technological advance toward a more "sustainable" society, actually has a much darker objective: the elimination of our freedom and privacy.

By eliminating cash, a system of total control over our transactions is established. Every purchase we make, every financial decision we make, will be monitored and evaluated. Under the guise of promoting responsible and sustainable consumption, surveillance of our spending will intensify, allowing external entities, possibly with hidden interests, to decide what is acceptable and what is not.

This centralized and authoritarian approach to consumption goes beyond what we might imagine. It strips us of the ability to freely choose how we spend our money, imposing criteria that are foreign to us and that, ultimately, are designed by those in power. The supposed convenience of digital transactions becomes a trap, where privacy is sacrificed on the altar of "sustainability."

The changes to come

The arrival of digital currency could define the future of humanity, but it also poses risks of control and mass surveillance. What is considered a modern advancement could become a trap that shackles society. It is crucial to question whether we are truly moving toward a better future or a digital prison.

Let's look at several points at what some economists and experts are saying on this topic.

1. Transfer of all bank accounts to the European Central Bank (ECB)

This is a big start! Statements by Ursula von der Leyen: "This month (March 2025), the European Commission will present the Savings and Investment Union. We will transform PRIVATE SAVINGS into much-needed investments."

The statements by Ursula von der Leyen—President of the European Commission, an undemocratic body that no one has elected and where European decisions are made behind the backs of citizens—have set off alarm bells. The idea of transferring all bank accounts to the European Central Bank (ECB) is not just a financial move; it is a bold step toward total control of private savings by the European elite.

The European Commission's proposal to convert savings into "much-needed" investments sounds like a dangerous euphemism: We are facing the imminent creation of a system where our savings will become tools to finance projects we do not want. It is an attempt to strip citizens of their financial autonomy under the pretext of collective well-being.

2. Will the banks protest?

Banks' business models are evolving; they are no longer focused on account management, which represents a significant cost. Instead, they will transform into financial services applications, leading them to close most of their branches and significantly reduce their workforce. This strategy will allow them to reduce fixed costs and, consequently, significantly increase their profits.

3. Traditional banks will no longer have customer accounts, only for loans and the like

Traditional banks will close customer accounts in the near future. Banks will prepare to transform themselves into mere intermediaries for loans and limited financial services, leaving behind the concept of savings and checking accounts as we know them. This move, which many believe is driven by the growing popularity of cryptocurrencies and fintechs, could be part of a broader plan to centralize financial control and weaken consumer autonomy.

4. Cash Ban: No Coins, No Bills

New digital currencies are being created with the goal of guiding, manipulating, incentivizing, punishing, promoting, and manipulating citizens' consumption, savings, and investment decisions. We are assured that the use of the Digital Euro will be optional and will coexist with cash, promising speed in transfers and protection of personal data.

However, it is essential to be clear and denounce the falsehood of this claim. The governor of the Central Bank of Italy, Fabio Panetta, has proposed establishing a limit of 50 euros for cash payments for goods or services. However, there could be a risk that, later on, banknotes and coins will be completely banned under any pretext.

Without banknotes or coins in circulation, the financial elite seems to be carrying out a master plan to establish a system of absolute control over our lives, a strategy to monitor every transaction and every movement of our resources. We will be witnessing the beginning of a new world order, where digital money and credit systems dictate our existence.

5. What does all this improve on what you already have right now? Do you have any benefits?

In most cases, NOTHING. So? The advantages are for the GOVERNMENT, not for you; everything else is a pipe dream.

6. From now on, everything you pay for will be recorded. Everything!

The government will know even the smallest and most intimate details of your life. For example, they'll be able to know if you use pads or tampons. Privacy is completely over; there's no cash. Remember?

7. The ECB claims that privacy will be fully guaranteed by the European Parliament

Do you trust it? I don't. They'll start by saying they use the data only for statistical purposes and will end up controlling your life. The European Central Bank argues that it has no interest in citizens' personal data, assuring them that it will not use it to influence our consumption, savings, and investment decisions. This argument would be comical if it weren't so serious, as it is a clearly false statement that is repeated every time a Central Bank bureaucrat refers to this issue. It is crucial that society understands what is coming and what is intended to be implemented.

8. Now you have lost control of your account; the state controls your money

The reality of state surveillance is becoming increasingly palpable. Imagine waking up one day to find that your bank account, which used to be a personal sanctuary, has turned into a battleground between the government and your rights. Now, fines and taxes will be deducted automatically, and anything the state wants to collect from you will simply be taken from your account, and they will serve themselves. The money is no longer yours!

9. Imposed Economic Restrictions

The design of the Digital Euro includes a mechanism, recently reported by the Bundesbank, that would impose an expiration date on money, forcing citizens to spend it before it expires, similar to perishable goods like yogurt. This would allow people's savings to be used forcibly to stimulate the economy, forcing individuals to spend for the benefit of companies the Central Bank deems a priority, under the pretext of environmental sustainability criteria.

Therefore, they can impose an obligation on you to spend your money within a certain time period and, in addition, set a maximum limit on the amount you can keep in your account. If you exceed that limit, the government will keep the surplus. Goodbye to savings!

10. The Threat of Negative Interest Rates

The possibility of implementing negative interest rates on checking accounts is being considered to incentivize spending instead of saving. From a monetary theory perspective, this is absurd, since money should be based on savings. Every loan should come from someone else's savings. Since 1971, this principle has been lost, and the fiat system has been exposed as a fraud, leading to economic imbalances such as artificial boom cycles and absent recessions.

Although this measure seeks to alleviate a crisis-ridden monetary system, it is not a problem unique to Europe; it is being replicated globally. Furthermore, the BRICS countries are developing a commodity-backed currency pegged to the digital yuan, which could alter the dynamics of this currency war that is being waged silently while we divert our attention to other matters.

11. Government Intervention in Our Consumption Decisions

The government will have the power to regulate your purchasing decisions, being able to ban certain foods, restrict the amount of meat and sugar you can buy, limit the purchase of tobacco, set a maximum purchase limit for beer or wine, control the amount of money you can spend daily, and even determine which stores you can access.

12. The state will be able to cancel any transaction it doesn't agree with

It can even ruin your life by excluding you from the system and leaving you without access to the Digital Euro. They won't even be able to give you alms, there's no cash, and you'll end up broke in a corner.

13. Under the justification of CO2, they will regulate your purchasing choices

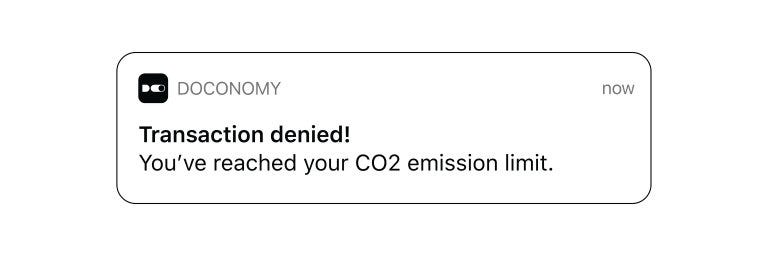

Under the justification of climate change, a regulation of purchasing choices based on the CO2 emissions of each product is proposed. This measure could mean that if you exceed a set monthly quota, you would be prohibited from purchasing more goods, creating controls on personal consumption in an attempt to reduce your carbon footprint.

Fantasy? There's already a card that works like this, called Doconomy. The European Union is very green and eco-sustainable.

14. We will convert PRIVATE SAVINGS into much-needed investments

Do you understand now what Ursula von der Leyen said: "We will convert PRIVATE SAVINGS into much-needed investments."

Where do you think they're going to get the 800 billion for defense? Disaster is a foregone conclusion.

15. Okay, but they're never going to implement that; it's nonsense.

It's coming in October 2025, of this very year.

16. But people would set fire to the streets if they implemented that!

Seriously? Do you remember what happened during the pandemic? People are sheepish; I don't have the slightest hope. The only thing you can do is leave, whoever can. But where? They'll impose this all over the world!

17. You'll have nothing, and you'll be happy. Remember?

Well, I'm not so sure about being happy.

18. This will happen globally

Anyone who thinks this will only happen in Europe is wrong. The United States2 has been planning to implement the digital dollar for several years.

Canada3 will sooner or later implement it as well:

As for China, the People's Bank of China (PBOC) has been conducting tests and experiments with the digital yuan for several years, and has made progress toward its implementation in several cities across the country.

Russia4 is making progress toward implementing its digital currency, known as the "digital ruble." The Central Bank of Russia has been working on this project for several years and plans to fully launch it by 2025. They are currently conducting pilot tests with banks, businesses, and consumers to ensure the system is efficient and secure.

In South America5, several countries are exploring or implementing central bank digital currencies (CBDCs):

One of the most advanced countries is Jamaica, with the pilot launch of its eCurrency in 2021.

Brazil is moving forward with its "digital real" project. They have worked on pilot tests and concepts to facilitate local and international transactions.

Chile is studying the feasibility of a "digital peso" to modernize its financial system.

Honduras and Guatemala are also in the initial stages of analyzing the implementation of digital currencies.

For the rest of the world, it's just a matter of time.

Have you noticed anything? Once again, the world's governments seem to be uniting to impose something on their citizens. It's curious! Remember what happened during the fake pandemic, when they tried to impose a vaccine loaded with graphene and nanotechnology? It seems they're aligning again!

The emergence of digital currencies has sparked an intense debate about individual freedom and privacy, as they can be used as instruments of authoritarian control. Governments and corporations could track every transaction, eliminating the anonymity traditionally provided by cash.

Thus, the promise of convenience is transformed into a mechanism of total surveillance and control, penalizing those who do not comply with the rules through restrictions on access to goods or asset freezes. There could even be the possibility that certain conditions, such as vaccination, may be required to fully access funds, highlighting the risks to our fundamental freedoms in a system where technology and control are intertwined.

Everyone should understand the seriousness of what this change will entail. It is one more piece in the puzzle for the imposition of a New World Order.

The reaction must be nothing short of revolutionary as in noncompliance.

Easy to say. The reality is compliance WILL happen-how will slaves function without money? This is the very reason all heads of states are liars and meet to plan this by occult means. Everything is a psyop to divert and divide and easily rule over the plebs. Same as since the Egypt rule.

This daunting! Combined this with everything else that is going on, and humans with a soul connection will be a thing of the past. If that is an alarming, I don’t know what is.

Yes!!!! Oh "For Christ's Sake [and yours people] help yourselves!" Soon Rev 13 will be obvious. And all the usual downplays about the Bible will be history https://youtube.com/shorts/6aJULJpWk8M?si=_dTYIbtCe68sIt7t