Bank Collapse

The Prelude to the New Mandatory Digital Monetary Order and the Loss of Our Assets

Financial markets are being rocked by a wave of bank failures that many believe are simply mismanagement. From the perspective of the hidden truth, these crises are a calculated step toward a new, compulsory digital monetary system that threatens to become a modern form of slavery.

Recent collapses, such as that of Credit Suisse in Switzerland and several US banks, including Silicon Valley Bank (SVB), the 16th largest US commercial bank with assets of $200 billion, are not isolated events.

Although the SVB claimed to have "solid financial foundations" shortly before its fall, something lies behind this "surprising collapse."

The unofficial trigger points to the actions of venture capital investors such as Peter Thiel, a member of the enigmatic Bilderberg group, and major investment banks like JPMorgan, who allegedly urged investors to withdraw their funds.

Thiel is a well-known proponent of the "creative destruction" theory, which posits that destruction is necessary to establish the New World Order. This call triggered a bank run that resulted in the withdrawal of $42 billion from the SVB in a single day.

But the real architect behind this chaos appears to be the Federal Reserve (FED) itself. After years of maintaining near-zero interest rates and flooding the system with new money, the Fed abruptly changed its policy due to inflation. It drastically raised rates and limited the amount of money in circulation. This created a situation that threatens the banks' existence, diminishing their cash flow and causing huge losses on their investments in government bonds due to falling prices. The SVB alone lost $15 billion in government debt. At the level of the US financial system, it is estimated that an incredible $1.9 trillion has been destroyed due to the Fed's interest rate policy.

Considering that the "total equity capital" of U.S. banks is less than $1.8 trillion, this suggests that the U.S. banking system has low liquidity and is virtually insolvent. The Fed, according to some, has generated a crisis that has already affected Credit Suisse and could trigger a global financial bankruptcy.

The "Solution" Is the Real Trap: The CBDC

Faced with this critical situation, the Fed presents an apparent solution: the Bank Term Funding Program (BTFP), guaranteeing deposits and allowing affiliated banks to operate even if they are insolvent. But, if we look closely, this is an "extremely clever chess move" by the Fed. By assuming these authority tasks, the Fed positions itself as the key player in the financial system.

And here comes the crucial point: this stance by the Fed is necessary to achieve public acceptance of the central bank digital currency (CBDC). The stated goal of the Fed, along with 114 other central banks and the world's major financial institutions, is to introduce this new digital monetary system, which will mean the end of cash as we know it. Accounts would no longer be held in commercial banks and would go directly to the central bank.

This CBDC is promoted to the public as a "safe haven" in the event of a crisis, since central banks are supposed to guarantee the safety of deposits. Banking panics and financial crises, therefore, can be seen as "key events" that push the population toward CBDCs and get them to accept this new system. Experts also point out that an impending financial crisis could be the perfect catalyst for introducing this new system. A payment system failure or a liquidity crisis could generate the necessary panic for people to accept solutions like CBDCs. Central banks are already preparing to offer digital "salvation" through these currencies.

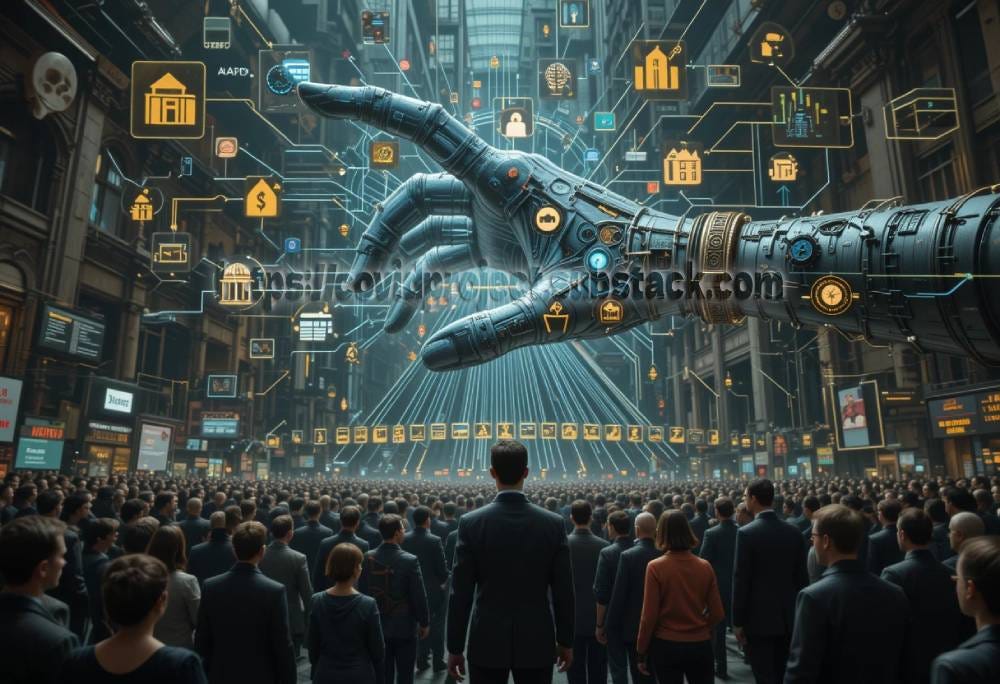

Total Control: A Modern Form of Slavery

But the CBDC isn't a salvation; it's a trap. This digital money system is nothing more than a modern form of slavery for people. It allows for unprecedented control. Every consumer behavior can be monitored. Governments or those who control central banks will be able to "turn the money spigot on or off" to impose their policies and will on humanity.

This transition is taking place "stealthily" and points to a global digital system. There is talk of distributed technologies and a diversification of digital assets, where even Ripple and its XRP asset could play a key role in interbank transactions. Central banks are massively stockpiling gold, perhaps preparing a backup for this new system.

This movement toward total digitalization isn't happening in a vacuum. It is part of a reconfiguration of the new world order. While the US dollar appears to be reaching the end of its hegemonic cycle due to excessive issuance and inflation, emerging blocs like the BRICS are looking for alternatives, even working on a new currency. China, with its growing economic clout, sees its own digital currency, the e-Yuan (e-CNY), as a way to escape the grip of the US-dominated SWIFT system and exert total control over its economy.

This is not a war of tanks, but a "silent war, a white-glove war, played out on the battlefield that hurts the most after the physical one: the economic one." Control of the financial system has been a powerful weapon for countries like the US, but China is reclaiming its role at the decision-making table.

The combination of a vulnerable global banking system, the imposition of centrally controlled digital currencies, and the financial elites' lust for power raises a chilling question: in the midst of a potential global financial bankruptcy driven by an impending crisis, could this technological and economic "major coup" lead us to a situation where our assets, being entirely digitized and under centralized control, risk disappearing or becoming inaccessible? Recall that the US banking system is already considered virtually insolvent, and interest rate hikes have "destroyed" trillions of dollars in the system. If digital "salvation" involves moving accounts directly to the central bank under a system that allows "turning off the money spigot," control over our savings and assets would be absolute. The lack of liquidity in the system and the possibility of widespread crises raise the specter that, in the process of transition or collapse, access to digital assets could be compromised on an unprecedented scale.

Artificial intelligence (AI) also emerges as a key factor. It is predicted to destroy the labor market, creating the need for a universal minimum income that, potentially channeled through CBDCs, would increase dependence on the state and erode financial freedom. Stopping retail CBDCs might require stopping AI, something seen as unlikely.

Reflection

(All the information presented above is based on research and analysis published on the Kla.tv platform. The following reflections are personal and do not reflect the opinions of the source).

Who controls central banks and seeks to impose their will through this digital system? According to some sources and alternative theories, the families featured in history, such as the Rothschilds, Rockefellers, and Warburgs, are merely pawns in a much larger and darker game. These families, often portrayed as puppeteers pulling the strings of economic power, are in fact mere marionettes in the hands of an even more powerful and hidden elite, operating from the shadows. Who are these entities that manipulate international finance, dictate policy, and seem to have an inordinate interest in imposing absolute digital control over the population?

Evidence suggests that there is a hidden power that transcends aristocratic families and governments, a power that remains in the shadows, invisible to most. Some researchers believe that these families are part of a secret network, a conclave of elites that has been operating for centuries, seeking to consolidate its dominance over all of humanity. The reality is that central banks, far from being independent institutions, are actually tools controlled by these groups, who design and foment crises, wars, and revolutions to maintain their control and expand their wealth.

The digital system currently imposed on us—the digitization of currencies, controlled cryptocurrencies, and surveillance platforms—is merely the latest step in a plan for total domination. The pursuit of a global, centralized, and digital financial system would respond to the interests of this hidden elite, which yearns for absolute control over every aspect of our lives. The key question is: what power is capable of pulling the strings in the shadows, beyond banks and governments, and what real interests are behind all this machinery?

The evidence, although scattered and often dismissed by official media, suggests that these families and their associates are nothing more than puppets following the orders of a supreme authority that prefers to remain anonymous. History shows us that, behind appearances, there is always an invisible force that manipulates events and public powers for its own benefit. The real question, then, is: who is this supreme entity? And what interests does it really pursue in its pursuit of total control over the planet?

Faced with this bleak outlook, which looms as the end of cash, the rise of state control, and the imposition of a system that could be a form of digital slavery, there is only one option: to become thoroughly informed about the risks and great dangers of this new monetary system and rise up against it.

I suggest it's non-human in origin, this other source on the planet that has infiltrated, taken over governments and corporations. It's acts through those families, and institutions, probably many have no idea of the take-over.

Because it operates in a range of frequencies, as the frequencies on the planet go up, (measurably) they will not be able to continue to control things. They'll fall away, hence the big push towards control.

Our best move is to keep our frequencies above those of control-range, support what we want more of us and refuse to go along with what we don't. Use cash.

This is all playing out for our benefit ultimately, for our breaking free of this non-human interference. Align with Nature.

Ultimately we have to see we've been controlled first, before we can take the wheel back.

Fascinating times.

So I get this notice in the mail for DL renewal stating I need renewal and Real ID compliance.

BS as suggestive but not stated that way.

It is being used to herd air travelers into compliance for air travel.

Turns out I can fly with DL, Passport.

ID is streamlined to get to gate with boarding pass. Carrot and stick beating our brains.

Trumps administration is pushing this thru the States! Libtard Mn will suck hard for a dime. It is. Gov tds governor will comply plus.

Talk to me about suggesting behavior as a form of mind control and softening the target.

I will renew my DL and that’s it.

And yes I got that sinking feeling that “it” is closing in.

Just a matter of time as realid is forced upon us. For that matter it may already be assigned awaiting the final compliance.

None of this transhumance stops until we over throw by massive non compliance.

But just this ID bs is a growth from stopping terrorism to board a plane.

The creeping by money use towards the stated goal is obvious. Seems unstoppable as they control the gates to freedom until we are trapped. CBDC

Reminds me of the wild boar experiment with corn…

Fuking sad state of affairs going on w/o a clue by the majority…